Predictions for the 2026 Mortgage Market in Kyle, TX

By Erica Bille, Leading Mortgage Broker in Kyle, TX

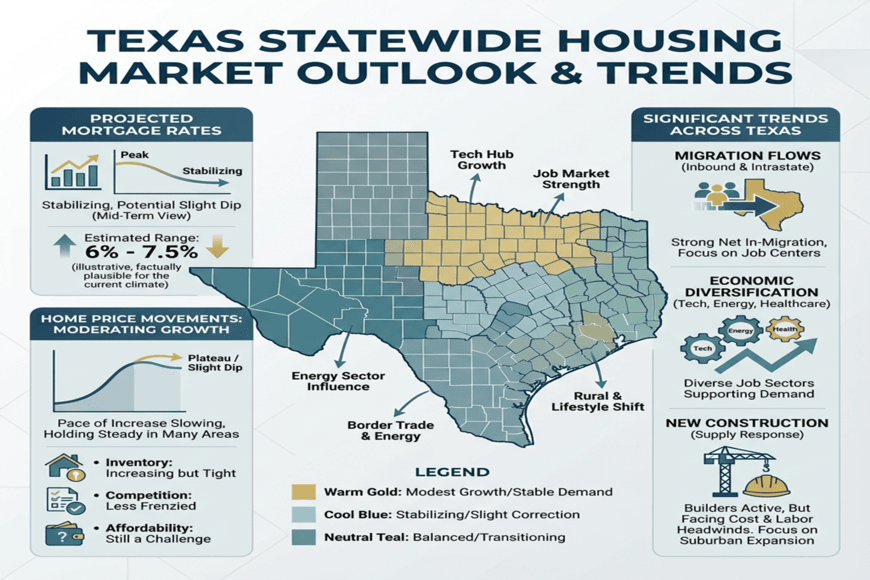

Kyle, the spirited suburb just south of Austin, has been a hotspot for Texas growth in 2025, drawing families and young professionals with its blend of small-town charm and big-city access. As rates stabilize and the local economy hums along – bolstered by tech expansions and population influxes – 2026 forecasts from the National Association of Realtors (NAR), Texas A&M Real Estate Research Center (TRERC), and Austin Board of Realtors paint a picture of balanced recovery. This in-depth analysis pulls from these sources to forecast mortgage rates, home price movements, origination trends, and Kyle-specific factors, helping buyers and refinancers in Hays County plan with confidence amid the Lone Star State’s dynamic housing pulse.

National Mortgage Rate Trends Shaping 2026

The U.S. mortgage market heads into 2026 with cautious optimism, as Federal Reserve cuts take deeper root. Fannie Mae projects the 30-year fixed-rate mortgage averaging 6% for the year, easing to 5.9% by December from 6.2% in late 2025, assuming inflation cools to 2.3% and the funds rate settles near 3%. NAR concurs, forecasting a steady 6% average, with potential for 5.5% in an aggressive-cut scenario or sticking at 6.5% if tariffs inflate costs. Adjustable-rate mortgages (ARMs) will be a wildcard: Resets from 2025 loans could drop below 6%, igniting refinance activity as Treasury yields stabilize around 4%.

In Kyle, where affordability drives decisions, this means more hybrid ARMs for move-up buyers eyeing $400,000 homes. Texas’ non-judicial foreclosure process adds appeal for fixed-rate locks, but brokers should highlight buydown options to bridge any mid-year volatility from energy sector swings.

Home Prices and Sales Volume: Steady Climb in Central Texas

Nationally, NAR anticipates 4% median home price growth in 2026, following 3% in 2025, with sales volumes rebounding 14% to 5.3 million units as pent-up demand unleashes. Fannie Mae’s revisions dial this back slightly to 7.3% sales growth and 0.4% price appreciation in their Home Value Index, reflecting regional pockets of softness.

Texas tells a localized story: TRERC projects statewide prices to rise 1-2% through mid-2026 before stabilizing, with Central Texas (including Kyle) outpacing at 2-4% due to Austin’s gravitational pull. Kyle’s median sales price, hovering at $350,000 in late 2025, could reach $365,000-$370,000 by year-end, supported by 5,000+ annual population gains and infrastructure like the upcoming I-35 expansions. Sales velocity may quicken to 45-50 days on market, up from 60, as inventory swells 10-15% from new builds in master-planned communities like Plum Creek. However, overbuilding in starter homes could cap entry-level appreciation at 1.5%, favoring negotiated concessions.

Mortgage Originations: Purchase Boom in the Suburbs

Origination volumes shine bright, with MBA estimating an 8% jump to $2.2 trillion in single-family loans, and loan counts up 7.6% to 5.8 million – 80% from purchases as buyers acclimate to 6% rates. Refinances may contribute 20%, per Fannie Mae, as ARM adjustments free up equity.

For Kyle, this national tide lifts local boats: Texas originations could grow 12%, driven by 200,000 net migrants seeking Austin-adjacent affordability. Hays County’s pipeline favors conforming loans under $766,550, but jumbo demand rises 10% for custom ranches. First-time buyers, 32% of Texas sales, will lean on Texas Department of Housing programs like My First Texas Home for 3-5% down payments.

Affordability and Buyer Sentiment in Focus

Affordability edges up nationally, with price-to-income ratios dipping to 5.5x, but in Kyle, it’s a tale of two markets: Median payments on $350,000 homes at 6% hit $2,100 – doable for $90,000 households but stretched by 3% property tax hikes and utility costs in a hot climate. Buyer sentiment? Robust – 65% of Central Texas respondents in NAR polls plan buys within 18 months, fueled by remote work and Kyle’s top-rated schools like Lehman High.

Millennials and Gen Z, eyeing townhomes under $300,000, drive 40% of activity, while retirees from pricier metros add stability. Challenges like HOA fees (averaging $200/month) may prompt education on total cost of ownership.

Emerging Trends: Technology and Sustainability

Tech integration ramps up: AI-powered pre-approvals could cut processing to 7 days, with 40% digital closings standard. In Texas, blockchain for title searches speeds rural escrows.

Sustainability surges: “Green” mortgages with 0.125% rate reductions for solar or drought-resistant features may snag 15% uptake in water-conscious Kyle, tying into state rebates for energy-efficient builds.

Key Challenges on the Horizon

Supply chains linger as hurdles, with new construction 10% below demand due to labor shortages. Regulatory tweaks, like FHA credit overlays, could exclude 5% of applicants. Locally, Kyle faces flood risks along Plum Creek – insurance up 10-12% – and rapid growth straining schools and roads, potentially cooling investor flips.

Geopolitical ripples, from oil volatility to border policies, add 0.25% rate risk.

Looking Ahead: Kyle’s Grounded Growth

2026 cements Kyle as a Texas success story, with easing rates and purchase surges balancing modest price gains. For brokers, it’s about empowering clients with tools like rate alerts and affordability calculators. As Austin’s shadow suburb evolves, timely action unlocks doors in this welcoming enclave.

Disclaimer:

The market information and rate forecasts in this article are based on publicly available data from sources such as NAR, Fannie Mae, MBA, and the Texas A&M Real Estate Research Center. These figures are projections only and not rate quotes or commitments to lend. Actual mortgage rates and terms vary based on borrower qualifications and market conditions. Contact Nest Mortgaging (NMLS 2377679) for personalized rate information.